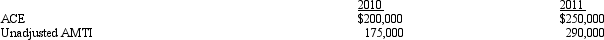

Mallard,Inc. ,is a C corporation that is not eligible for the small business exception to the AMT.Its adjusted current earnings (ACE)and unadjusted alternative minimum taxable income (unadjusted AMTI)for 2010 and 2011 are as follows:

Calculate the amount of the ACE adjustment for 2010 and 2011.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Barb and Chuck each own one-half the

Q81: Alice contributes equipment (fair market value of

Q84: Agnes is going to invest $90,000 in

Q84: Alanna contributes property with an adjusted basis

Q88: Blue,Inc. ,has taxable income before salary payments

Q89: Candace, who is in the 33% tax

Q89: Mr.and Ms.Smith's partnership owns the following assets:

Q90: Kirby,the sole shareholder of Falcon,Inc. ,leases a

Q92: Brenda contributes appreciated property to her business

Q94: Melba contributes land (basis of $190,000; fair

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents