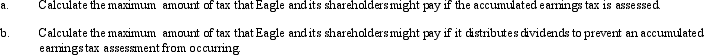

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $600,000 in 2010.Assume that its shareholders are in the 35% marginal tax bracket.

Correct Answer:

Verified

Q84: Which of the following special allocations are

Q94: Devon owns 30% of the Agate Company

Q95: Bart contributes $100,000 to the Tuna Partnership

Q96: Kristine owns all of the stock of

Q98: Which of the following statements is correct?

A)The

Q100: Daisy,Inc. ,has taxable income of $850,000 during

Q101: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q103: Which of the following business entity forms

Q105: Why are S corporations not subject to

Q109: Aubrey has been operating his business as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents