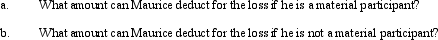

Maurice purchases a bakery from Philip for $350,000.He spends an additional $100,000 (financed with a nonrecourse loan)updating the bakery equipment.During the first year of operations as a sole proprietorship,the bakery incurs a loss of $75,000.

Correct Answer:

Verified

Q101: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q102: What tax rates apply for the AMT

Q103: Which of the following business entity forms

Q105: Swallow,Inc. ,is going to make a distribution

Q105: Why are S corporations not subject to

Q107: Lee owns all the stock of Vireo,Inc.

Q108: Parrot,Inc. ,a C corporation,distributes $300,000 to its

Q109: Aubrey has been operating his business as

Q109: Sam and Vera are going to establish

Q111: Ashley contributes property to the TCA Partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents