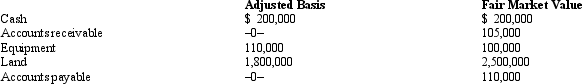

Apple,Inc. ,a cash basis S corporation in Orange,Texas,formerly was a C corporation.Apple has the following assets and liabilities on January 1,2010,the date the S election is made.

During 2010,Apple collects the accounts receivable and pays the accounts payable.The land is sold for $3 million,and taxable income for the year is $590,000.What is Apple's built-in gains tax?

A) $0.

B) $206,500.

C) $590,000.

D) $695,000.

E) Some other amount.

Correct Answer:

Verified

Q81: Which statement is false?

A)An S corporation is

Q87: On January 1,Bobby and Alice own equally

Q91: A C corporation elects S status.The corporation

Q97: During 2010,Lion Corporation incurs the following transactions.

Q97: A calendar year C corporation has a

Q98: On January 1,Bobby and Alice own equally

Q99: Which,if any,of the following items has no

Q103: When an S corporation liquidates,which of its

Q104: During 2010,an S corporation in Flint,Michigan,has a

Q105: When Gail dies,she owns 100% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents