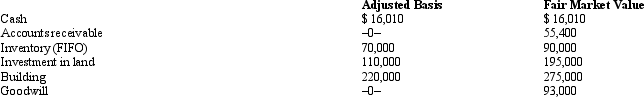

Crew Corporation elects S status effective for tax year 2010.As of January 1,2010,Crew's assets were appraised as follows.

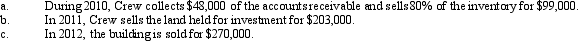

In each of the following situations,calculate any built-in gains tax,assuming that the highest corporate tax rate is 35%.C corporation taxable income would have been $100,000.

Correct Answer:

Verified

Q85: Excess net passive income of an S

Q106: Estela,Inc. ,a calendar year S corporation,incurred the

Q107: Bidden,Inc. ,a calendar year S corporation,incurred the

Q108: Malin,a 51% owner of an S corporation,has

Q112: An S corporation reports $10,000 DPGR and

Q116: Yates Corporation elects S status,effective for calendar

Q125: Dawn Adams owns 60% of a calendar

Q134: Brew,an S corporation,has gross receipts of $190,000

Q137: On December 31,2009,Erica Sumners owns one share

Q152: Outline the requirements that an entity must

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents