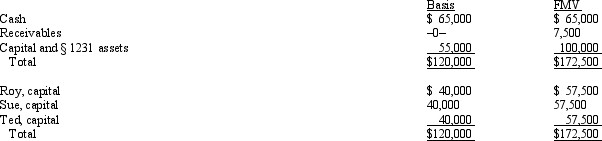

The December 31,2010,balance sheet of the RST General Partnership reads as follows.

The partners share equally in partnership capital,income,gain,loss,deduction and credit.Ted's adjusted basis for his partnership interest is $40,000.On December 31,2010,he retires from the partnership,receiving a $60,000 cash payment in liquidation of his interest.The partnership agreement states that $2,500 of the payment is for goodwill.Which of the following statements about this distribution is false?

A) If capital is NOT a material income-producing factor to the partnership,the § 736(a) payment will be $2,500.

B) If capital IS a material income-producing factor,the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount which is a § 736(a) payment since it will be determined without regard to partnership profits.

E) All statements are false.

Correct Answer:

Verified

Q40: The ABC Partnership makes a proportionate distribution

Q64: In a proportionate liquidating distribution, Lina receives

Q68: Cynthia sells her 1/3 interest in the

Q72: Carla,Marla,and Yancy are equal partners in the

Q72: A partnership may make an optional election

Q76: Which of the following distributions would never

Q78: Last year, Darby contributed land (basis of

Q136: Which of the following statements about the

Q137: Paul is a 25% owner in the

Q138: In a proportionate liquidating distribution,Barbara receives a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents