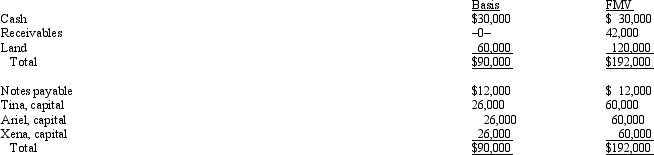

Tina sells her 1/3 interest in the TAX Partnership to James for $60,000 cash plus the assumption of Tina's $4,000 share of partnership debt.On the sale date,the partnership balance sheet and agreed-upon fair market values were as follows:

As a result of the sale,Tina recognizes:

A) No gain or loss.

B) $34,000 capital gain.

C) $38,000 capital gain.

D) $14,000 ordinary income and $20,000 capital gain.

E) $14,000 capital gain and $24,000 ordinary income.

Correct Answer:

Verified

Q40: The ABC Partnership makes a proportionate distribution

Q63: Partner Jordan received a distribution of $80,000

Q64: Barney,Bob,and Billie are equal partners in the

Q64: In a proportionate liquidating distribution, Lina receives

Q65: Which of the following statements is true

Q68: Cynthia sells her 1/3 interest in the

Q75: Tom and Terry are equal owners in

Q76: In a proportionate liquidating distribution, Scott receives

Q135: Which of the following is not typically

Q138: In a proportionate liquidating distribution,Barbara receives a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents