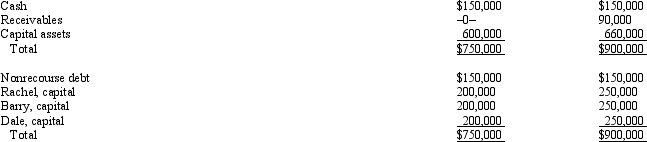

On August 31 of the current tax year,the balance sheet of the RBD General Partnership is as follows:

On that date,Rachel sells her one-third partnership interest to Bill for $300,000,including cash and relief of Rachel's share of the nonrecourse debt.The nonrecourse debt is shared equally among the partners.Rachel's outside basis for her partnership interest is $250,000.How much capital gain and/or ordinary income will Rachel recognize on the sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: On December 31 of last year,Pat gave

Q31: Last year,Oscar contributed nondepreciable property with a

Q68: Which of the following transactions will not

Q83: Cindy,a 20% general partner in the CDE

Q86: Your client has operated a sole proprietorship

Q87: The December 31,2010,balance sheet of the calendar-year

Q88: In a proportionate liquidating distribution in which

Q130: Which of the following statements correctly reflects

Q134: Which of the following statements,if any,about an

Q152: Marilyn is a partner in a continuing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents