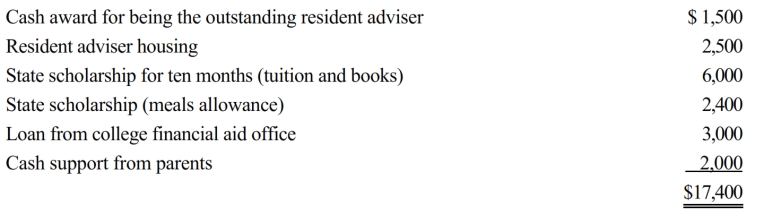

Ron, age 19, is a full-time graduate student at City University. During 2018, he received the following payments:

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied. What is Ron's adjusted gross income for 2018?

A) $1,500.

B) $3,900.

C) $9,000.

D) $15,400.

E) None of these.

Correct Answer:

Verified

Q25: A U.S.citizen is always required to include

Q34: Roger is in the 35% marginal tax

Q36: Mia participated in a qualified state tuition

Q37: Fresh Bakery often has unsold donuts at

Q39: The taxpayer incorrectly took a $5,000 deduction

Q41: Iris collected $150,000 on her deceased husband's

Q42: Early in the year, Marion was in

Q43: Turquoise Company purchased a life insurance policy

Q45: Matilda works for a company with 1,000

Q46: The exclusion for health insurance premiums paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents