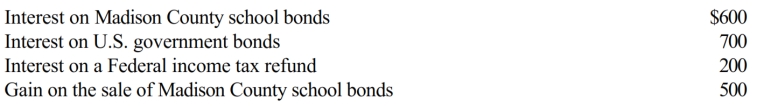

Heather's interest and gains on investments for the current year are as follows:

Heather's adjusted gross income from the above is: or? Heather must report gross income in the amount of:

A) $2,000.

B) $1,800.

C) $1,400.

D) $1,300.

E) None of these.

Correct Answer:

Verified

Q64: The Royal Motor Company manufactures automobiles.Nonmanagement employees

Q67: Evaluate the following statements: I.De minimis fringe

Q78: The plant union is negotiating with the

Q79: Randy is the manager of a motel.

Q80: Adam repairs power lines for the Egret

Q82: George, an unmarried cash basis taxpayer, received

Q84: Sandy is married, files a joint return,

Q86: Barbara was injured in an automobile accident.

Q91: Assuming a taxpayer qualifies for the exclusion

Q96: Barry, a solvent individual but a recovering

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents