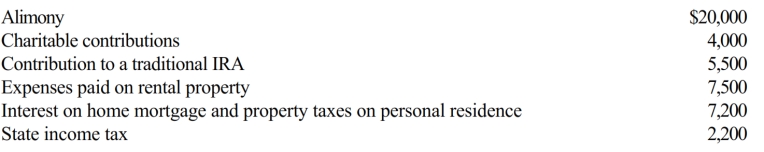

Al is single, age 60, and has gross income of $140,000. His deductible expenses are as follows:

What is Al's AGI?

A) $94,100.

B) $103,000.

C) $107,000.

D) $127,000.

E) None of the above.

Correct Answer:

Verified

Q42: If a vacation home is a personal/rental

Q46: If a vacation home is classified as

Q55: Marsha is single, had gross income of

Q56: Purchased goodwill must be capitalized but can

Q58: If a publicly-traded corporation hires a new

Q61: Which of the following is incorrect?

A) Alimony

Q62: Which of the following is a deduction

Q63: Terry and Jim are both involved in

Q64: Which of the following may be deductible

Q65: Benita incurred a business expense on December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents