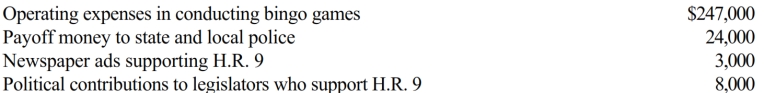

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2018, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2018, Rex had the following expenses:

Of these expenditures, Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Q74: Tommy, an automobile mechanic employed by an

Q75: Which of the following is a required

Q76: Which of the following can be claimed

Q77: Which of the following is not a

Q78: Which of the following is correct?

A) A

Q80: For a president of a publicly held

Q81: Which of the following is not a

Q82: Because Scott is three months delinquent on

Q83: In January, Lance sold stock with a

Q84: Sandra owns an insurance agency. The following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents