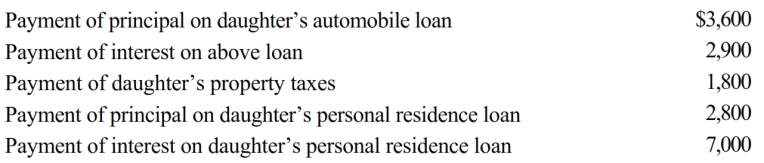

Melba incurred the following expenses for her dependent daughter during the current year:

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Q92: Cory incurred and paid the following expenses

Q93: Nikeya sells land (adjusted basis of $120,000)

Q94: Bob and April own a house at

Q95: Robyn rents her beach house for 60

Q96: If a residence is used primarily for

Q98: Which of the following is not deductible

Q99: On January 2, 2018, Fran acquires a

Q100: Which of the following is not relevant

Q101: Mattie and Elmer are separated and are

Q102: While she was a college student, Angel

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents