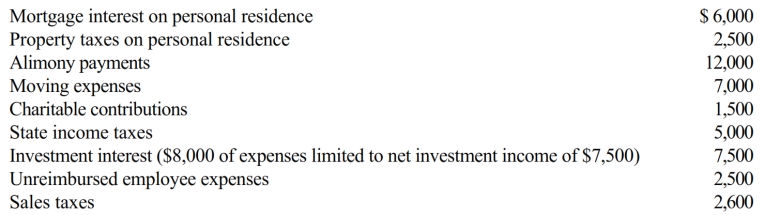

Arnold and Beth file a joint return in 2018. Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: Alfred's Enterprises, an unincorporated entity, pays employee

Q100: Robin and Jeff own an unincorporated hardware

Q102: During the year, Jim rented his vacation

Q110: Agnes operates a Christmas Shop in Atlantic

Q112: Kitty runs a brothel (illegal under state

Q113: Janet is the CEO for Silver, Inc.,

Q114: Calculate the net income includible in taxable

Q118: Bridgett's son, Clyde, is $12,000 in arrears

Q119: During the year, Rita rented her vacation

Q120: In order to protect against rent increases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents