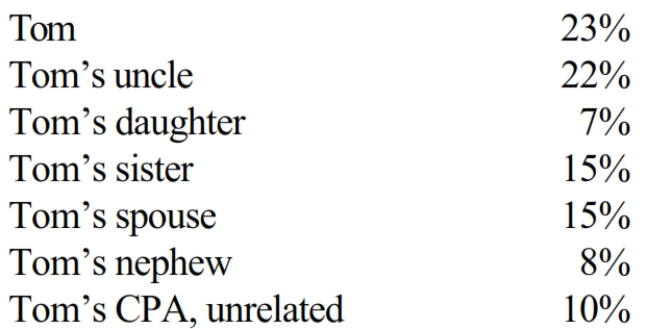

The stock of Eagle, Inc. is owned as follows:

Tom sells land and a building to Eagle, Inc. for $212,000. His adjusted basis for these assets is $225,000. Calculate

Tom's realized and recognized loss associated with the sale.

Correct Answer:

Verified

Q112: Can a trade or business expense be

Q124: Sandra sold 500 shares of Wren Corporation

Q126: If part of a shareholder/employee's salary is

Q127: Graham, a CPA, has submitted a proposal

Q127: Salaries are considered an ordinary and necessary

Q128: Discuss the application of the "one-year rule"

Q129: Max opened his dental practice (a sole

Q132: Briefly discuss the two tests that an

Q133: What losses are deductible by an individual

Q136: Bobby operates a drug-trafficking business. Because he

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents