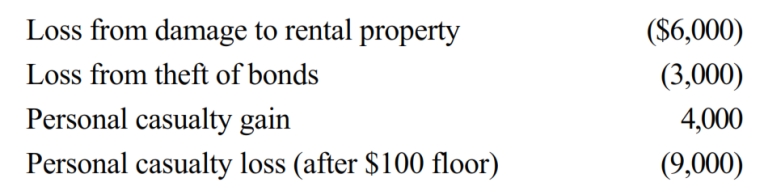

In 2018, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:

The personal casualties occurred in a Federally-declared disaster area. Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

Correct Answer:

Verified

Q65: Which of the following events would produce

Q66: In the current year, Juan's home was

Q67: Blue Corporation incurred the following expenses in

Q68: In 2017, Sarah (who files as single)

Q69: Alma is in the business of dairy

Q71: Alicia was involved in an automobile accident

Q72: Regarding research and experimental expenditures, which of

Q73: Last year, Green Corporation incurred the following

Q74: In 2018, Grant's personal residence was completely

Q75: In 2018, Mary had the following items:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents