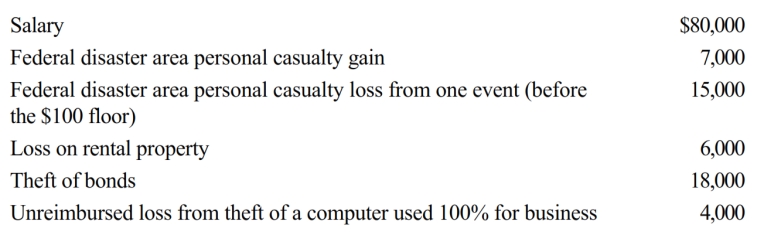

Gary, who is an employee of Red Corporation, has the following items for 2018:

Determine Gary's AGI and total amount of itemized deductions for 2018.

Correct Answer:

Verified

Q85: While Susan was on vacation during the

Q87: Neal, single and age 37, has the

Q88: In 2017, Robin Corporation incurred the following

Q89: Susan has the following items for 2018:

?

Q91: Roger, an individual, owns a proprietorship called

Q92: In 2018, Tan Corporation incurred the following

Q93: Julie, who is single, has the following

Q104: What are the three methods of handling

Q107: Discuss the tax treatment of nonreimbursed losses

Q109: Identify the factors that should be considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents