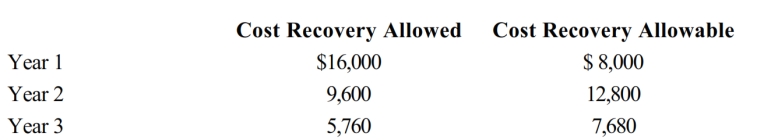

Tara purchased a machine for $40,000 to be used in her business. The cost recovery allowed and allowable for the three years the machine was used are computed as follows.

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

A) $3,480

B) $6,360

C) $9,240

D) $11,480

E) None of the above

Correct Answer:

Verified

Q22: The amortization period for $58,000 of startup

Q29: Cost depletion is determined by multiplying the

Q32: Percentage depletion enables the taxpayer to recover

Q43: Hazel purchased a new business asset (five-year

Q45: Which of the following assets would be

Q47: Assets that do not decline in value

Q50: Alice purchased office furniture on September 20,

Q57: Under MACRS, equipment falling in the 7-year

Q58: When a business is being purchased, if

Q60: Under MACRS, the double-declining balance method is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents