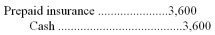

On July 1,20A,Hale Company paid a two-year insurance premium.On that date the following journal entry was made:

The annual accounting period ends on December 31.

A.How much of the premium should be reported as expense on the 20A income statement? $

B.What is the amount of prepaid insurance which should be reported on the statement of financial position at December 31,20A? $

C.Give the adjusting entry that should be made on December 31,20A.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: A. Explain how the income statement relates

Q113: Below are two related transactions for Tweet

Q114: A post-closing trial balance is the last

Q115: Four transactions are given below that were

Q116: Below,to the left,are listed several different account

Q118: On January 1,20C,the balance in the prepaid

Q120: The following trial balance of Lazy Corporation

Q121: For each of the following transactions,indicate the

Q123: Air Cargo Company recorded the following adjusting

Q124: At December 31,20A,the following adjusting entries were

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents