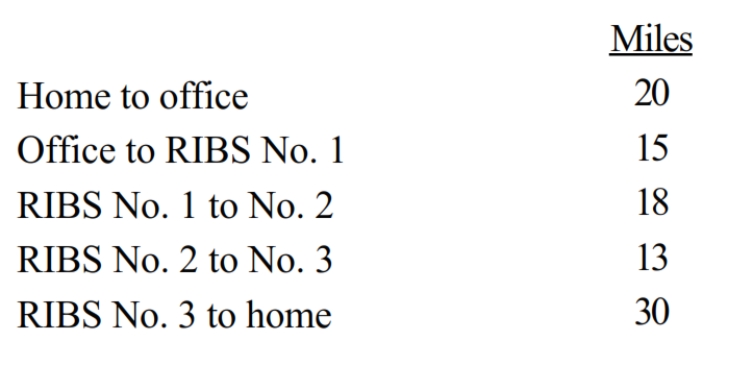

Corey is the city sales manager for "RIBS," a national fast food franchise. Every working day, Corey drives his car as follows:

Corey renders an adequate accounting to his employer. As a result, Corey's reimburseable mileage is:

A) 0 miles.

B) 50 miles.

C) 66 miles.

D) 76 miles.

E) None of these.

Correct Answer:

Verified

Q36: For the spousal IRA provision to apply,

Q37: Distributions from a Roth IRA that are

Q74: Allowing for the overall limitation (50% reduction

Q75: Tax advantages of being self-employed (rather than

Q76: An individual, age 40, who is not

Q77: Aiden performs services for Lucas. Which, if

Q81: Fran is a CPA who has a

Q82: Ralph made the following business gifts during

Q83: Which, if any, of the following expenses

Q85: Which of the following expenses, if any,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents