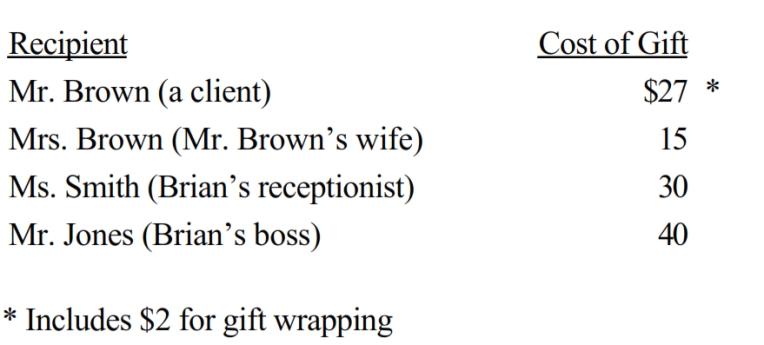

Brian makes gifts as follows:

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Nick Lee is a linebacker for the

Q108: Once set for a year, when might

Q113: How are combined business/pleasure trips treated for

Q117: When is a taxpayer's work assignment in

Q121: During 2018, Eva (a self-employed accountant who

Q122: Arnold is employed as an assistant manager

Q123: Christopher just purchased an automobile for $40,000

Q125: In terms of income tax treatment, what

Q128: Travel status requires that the taxpayer be

Q129: Lily (self-employed) went from her office in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents