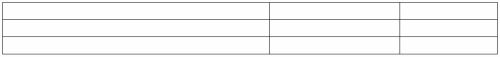

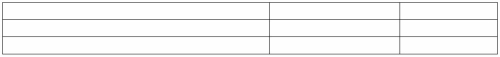

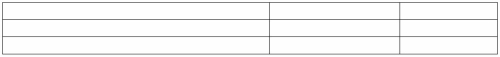

On April 1,20B,Larel Corporation issued $40,000,9%,ten-year bonds payable at 108 that were dated April 1,20B.Interest is payable each March 31 and September 30.

(a)Give the entry to record the issuance of the bonds on April 1,20B

(b)Give the entry to record the first interest payment on September 30,20B.Use straight-line amortization

(c)Give the adjusting entry required on December 31,20B,the end of the annual accounting period.Use straight-line amortization

Correct Answer:

Verified

Q35: An annuity is a series of consecutive

Q127: The present value of an annuity is

Q135: Typically,an indenture is a separate cash fund

Q136: On January 1,20B,Dole Corporation sold (issued)400 of

Q136: When the effective-interest amortization method is used,

Q138: Match the way a bond will sell

Q141: On October 1,20A,Britt Company issued a $5,000,6%,bond

Q142: Watson Company purchased a truck that cost

Q143: The following information was taken from the

Q144: On November 1,20A,Rossy Co.purchased $100,000,9%,ten-year bonds of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents