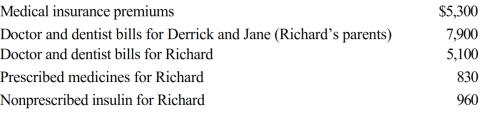

Richard, age 50, is employed as an actuary. For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019. What is Richard's maximum allowable medical expense deduction for 2018?

A) $0

B) $7,090

C) $10,340

D) $20,090

E) None of the above

Correct Answer:

Verified

Q45: Employee business expenses for travel may be

Q46: Maria made significant charitable contributions of capital

Q47: Fred and Lucy are married, ages 33

Q47: Excess charitable contributions that come under the

Q49: During the year, Victor spent $300 on

Q51: Contributions to public charities in excess of

Q52: This year Allison drove 800 miles to

Q54: During the year, Eve (a resident of

Q57: Dan contributed stock worth $16,000 to his

Q60: Charitable contributions that exceed the percentage limitations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents