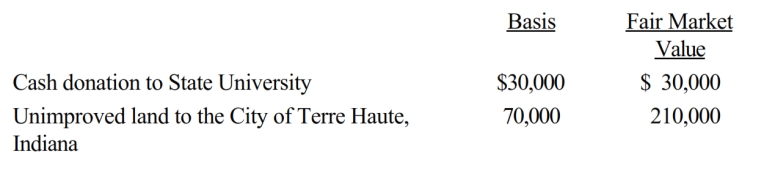

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:

The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of the above.

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q67: Pedro's child attends a school operated by

Q70: Your friend Scotty informs you that he

Q71: Zeke made the following donations to qualified

Q72: In the current year, Jerry pays $8,000

Q76: Brad, who uses the cash method of

Q77: Brad, who would otherwise qualify as Faye's

Q78: Hugh, a self-employed individual, paid the following

Q79: In Lawrence County, the real property tax

Q80: Tom, age 48, is advised by his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents