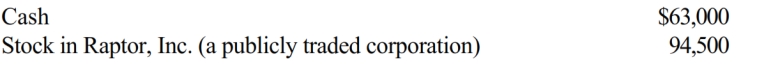

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

A) $56,700

B) $63,000

C) $94,500

D) $157,500

E) None of the above

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q63: Byron owned stock in Blossom Corporation that

Q64: Nancy paid the following taxes during the

Q65: Hannah makes the following charitable donations in

Q66: Quinn, who is single and lives alone,

Q67: In 2018, Boris pays a $3,800 premium

Q69: Barry and Larry, who are brothers, are

Q70: Your friend Scotty informs you that he

Q71: Zeke made the following donations to qualified

Q72: In the current year, Jerry pays $8,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents