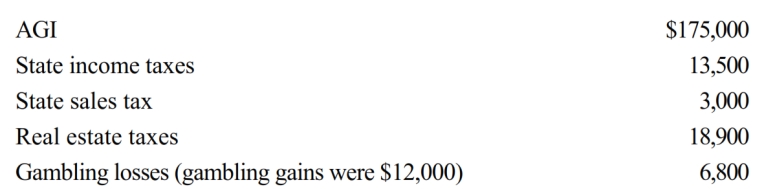

Paul, a calendar year single taxpayer, has the following information for 2018:

Paul's allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Q78: Hugh, a self-employed individual, paid the following

Q79: In Lawrence County, the real property tax

Q80: Tom, age 48, is advised by his

Q81: Harry and Sally were divorced three years

Q82: In Piatt County, the real property tax

Q82: Helen pays nursing home expenses of $3,000

Q85: For calendar year 2018, Jon and Betty

Q86: Brian, a self-employed individual, pays state income

Q88: Which of the following items would be

Q96: For the past several years, Jeanne and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents