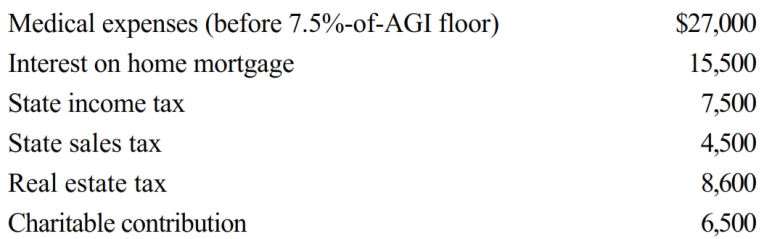

George is single and age 56, has AGI of $265,000, and incurs the following expenditures in 2018.

What is the amount of itemized deductions George may claim?

Correct Answer:

Verified

Q89: Diane contributed a parcel of land to

Q92: Pat gave 5,000 shares of stock in

Q93: Marilyn, age 38, is employed as an

Q94: Georgia had AGI of $100,000 in 2018.

Q95: During 2018, Kathy, who is self-employed, paid

Q96: Shirley sold her personal residence to Mike

Q98: Charles, who is single and age 61,

Q99: Aaron, age 45, had AGI of $70,000

Q100: Paul and Patty Black (both are age

Q101: Joe, who is in the 32% tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents