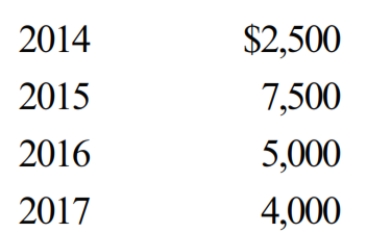

Molly has generated general business credits over the years that have not been utilized. The amounts generated and not utilized follow:

In the current year, 2018, her business generates an additional $15,000 general business credit. In 2018, based on her tax liability before credits, she can utilize a general business credit of up to $20,000. After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2018 is available for future years?

A) $0.

B) $1,000.

C) $14,000.

D) $15,000.

E) None of the above.

Correct Answer:

Verified

Q30: Qualifying tuition expenses paid from the proceeds

Q32: The base amount for the Social Security

Q56: The components of the general business credit

Q58: Ahmad is considering making a $10,000 investment

Q59: Juan refuses to give the bank where

Q61: Black Company paid wages of $180,000, of

Q62: Cardinal Corporation hires two persons certified to

Q63: In March 2018, Gray Corporation hired two

Q64: Which, if any, of the following correctly

Q65: George and Jill are husband and wife,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents