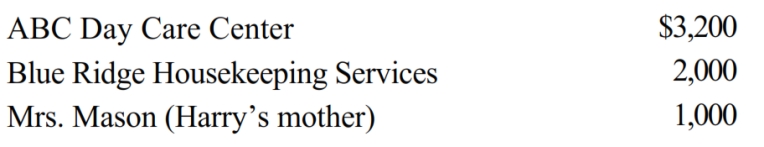

Harry and Wilma are married and file a joint income tax return. On their tax return, they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wilma) and claim two exemptions for their dependent children. During the year, they pay the following amounts to care for their 4-year old son and 6-year old daughter while they work.

Harry and Wilma may claim a credit for child and dependent care expenses of:

A) $840.

B) $1,040.

C) $1,200.

D) $1,240.

E) None of the above.

Correct Answer:

Verified

Q71: Amber is in the process this year

Q72: Which, if any, of the following correctly

Q73: Cheryl is single, has one child (age

Q75: During the year, Green, Inc., incurs the

Q77: In 2017, Juan and Juanita incur $9,800

Q78: Rex and Dena are married and have

Q79: Green Company, in the renovation of its

Q81: Which of the following statements is true

Q82: During the year, Purple Corporation (a U.S.

Q86: During the year, Green Corporation (a U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents