Summer Corporation's business is international in scope and is subject to income taxes in several countries.

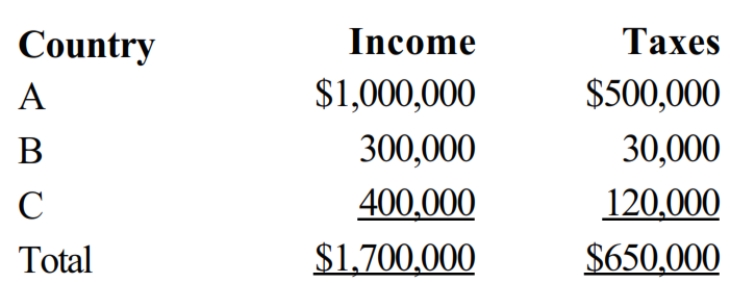

Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S. income tax due prior to the foreign tax credit is $504,000, compute the allowable foreign tax credit. If, instead, the total foreign income taxes paid were $250,000, compute the allowable foreign tax credit.

Correct Answer:

Verified

Q87: Which of the following correctly reflects current

Q96: Realizing that providing for a comfortable retirement

Q97: Jermaine and Kesha are married, file a

Q98: Which of the following statements concerning the

Q99: During the current year, Eleanor earns $120,000

Q102: Phil and Audrey, husband and wife, both

Q103: Jack and Jill are married, have three

Q104: Dabney and Nancy are married, both gainfully

Q105: In May 2018, Blue Corporation hired Camilla,

Q106: Susan generated $55,000 of net earnings from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents