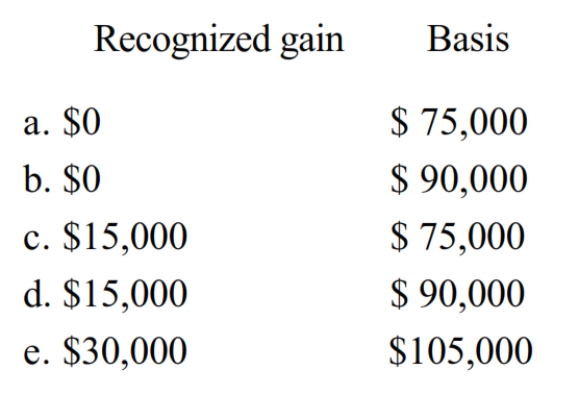

Nat is a salesman for a real estate developer. His employer permits him to purchase a lot for $75,000. The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer:

Verified

Q133: Shontelle received a gift of income-producing property

Q134: Kevin purchased 5,000 shares of Purple Corporation

Q135: Neal and his wife Faye reside in

Q136: Ralph gives his daughter, Angela, stock (basis

Q137: Nontaxable stock dividends result in:

A) A higher

Q139: Which of the following is correct?

A) The

Q140: Over the past 20 years, Alfred has

Q141: Lynn purchases a house for $52,000. She

Q142: Latisha owns a warehouse with an adjusted

Q143: Valarie purchases a rental house and land

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents