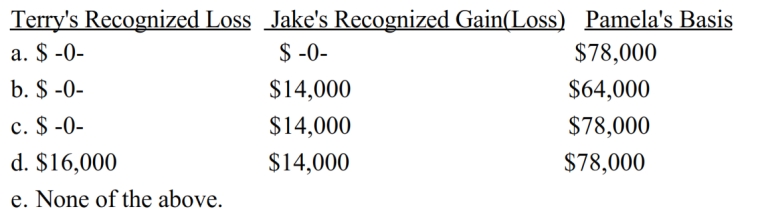

Terry owns Lakeside, Inc. stock (adjusted basis of $80,000), which she sells to her brother, Jake, for $64,000 (its fair market value). Eighteen months later, Jake sells the stock to Pamela, a friend, for $78,000 (its fair market value). What is Terry's recognized loss, Jake's recognized gain or loss, and Pamela's adjusted basis for the stock?

Correct Answer:

Verified

Q146: Alice owns land with an adjusted basis

Q147: Arthur owns a tract of undeveloped land

Q148: In order to qualify for like-kind exchange

Q149: Karen purchased 100 shares of Gold Corporation

Q150: Kelly inherits land which had a basis

Q152: Paul sells property with an adjusted basis

Q153: Andrew acquires 2,000 shares of Eagle Corporation

Q154: Taylor inherited 100 acres of land on

Q155: Karen purchased 100 shares of Gold Corporation

Q156: Which, if any, of the following exchanges

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents