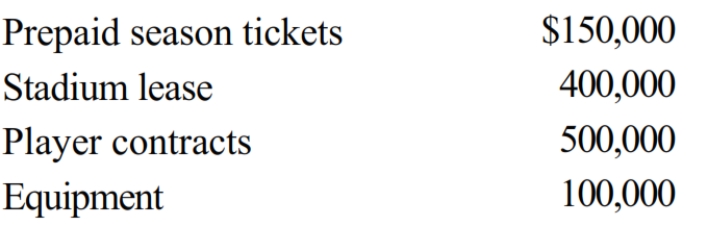

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million. The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years. Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q197: Hilary receives $10,000 for a 15-foot wide

Q215: Jan purchases taxable bonds with a face

Q216: On September 18, 2018, Jerry received land

Q216: When a property transaction occurs, what four

Q217: Melody's adjusted basis for 10,000 shares of

Q218: Emma gives her personal use automobile (cost

Q221: Eunice Jean exchanges land held for investment

Q222: Jake exchanges an airplane used in his

Q223: Liz, age 55, sells her principal residence

Q224: Patty's factory building, which has an adjusted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents