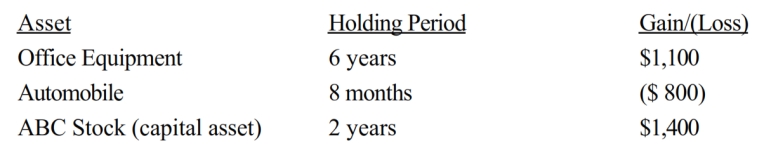

The following assets in Jack's business were sold in 2018:

The office equipment had a zero adjusted basis and was purchased for $8,000. The automobile was purchased for $2,000 and sold for $1,200. The ABC stock was purchased for $1,800 and sold for $3,200. In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

A) $1,700 LTCG.

B) $600 LTCG and $300 ordinary gain.

C) $1,400 LTCG and $300 ordinary gain.

D) $2,500 LTCG and $800 ordinary loss.

E) None of the above.

Correct Answer:

Verified

Q97: Which of the following assets held by

Q98: Seamus had $16,000 of net short-term capital

Q99: Robin Corporation has ordinary income from operations

Q100: Which of the following assets held by

Q101: An individual had the following gains and

Q103: Which of the following would be included

Q104: Which of the following is correct?

A) Improperly

Q105: Copper Corporation sold machinery for $47,000 on

Q106: Orange Company had machinery destroyed by a

Q107: Which of the following real property could

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents