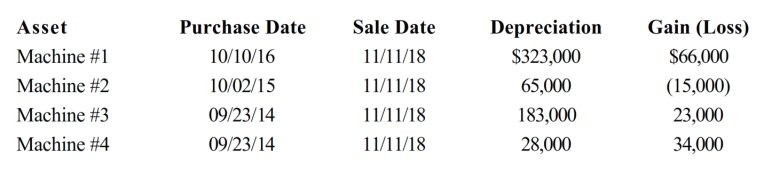

A business taxpayer sold all the depreciable assets of the business, calculated the gains and losses, and would like to know the final character of those gains and losses. The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets. The taxpayer had unrecaptured § 1231 lookback loss of $22,000. What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self- employment tax deduction.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: A barn held more than one year

Q118: Which of the following creates potential §

Q119: Blue Company sold machinery for $45,000 on

Q120: A retail building used in the business

Q121: An individual has the following recognized gains

Q123: A business taxpayer sold all the depreciable

Q124: Sharon has the following results of netting

Q125: On January 18, 2017, Martha purchased 200

Q126: Which of the following would extinguish the

Q127: An individual has a $40,000 § 1245

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents