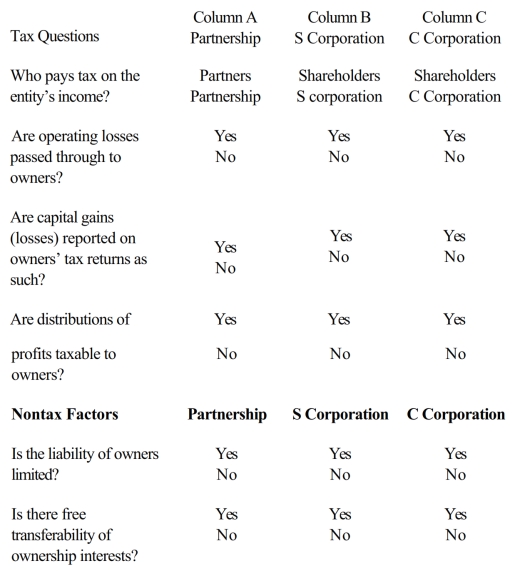

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

Q48: Which of the following self-employed individuals are

Q49: Jason and Paula are married. They file

Q50: The qualified business income deduction is severely

Q51: Which of the following taxpayers is eligible

Q54: Susan, a single taxpayer, owns and operates

Q55: Taylor, a single taxpayer, has taxable income

Q56: Alicia is the sole shareholder and CEO

Q57: Ben owns and operates as a sole

Q58: Tanuja Singh is a CPA and operates

Q63: How does property used in a qualified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents