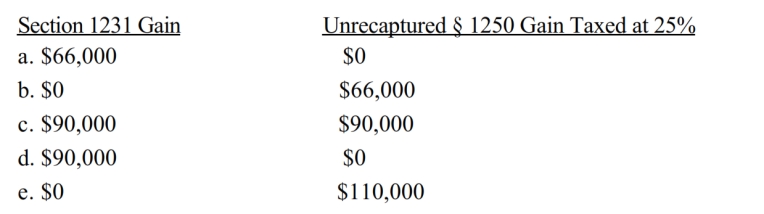

Albert is in the 35% marginal tax bracket. He sold a building in the current year for $450,000. Albert received $110,000 cash at closing, the buyer assumed Albert's mortgage for $120,000, and the buyer gave Albert a 6% note for $220,000 due in two years. The Federal rate was 6%. Albert's basis in the building was $180,000 ($500,000 cost -$320,000 accumulated straight-line depreciation). Assuming he did not elect out of the installment method, Albert's § 1231 gain and gain taxed at the 25% rate in the year of sale are what amounts?

Correct Answer:

Verified

Q75: In 2018, Norma sold Zinc, Inc., common

Q76: This year, Sarah started a business selling

Q77: Camelia Company is a large commercial real

Q78: In 2018, Father sold land to Son

Q79: Walter sold land (a capital asset) to

Q82: Ramon sold land in 2018 with a

Q83: In 2019, Brown Corporation, a service business,

Q84: Using your knowledge of GAAP and financial

Q85: Dr. Stone incorporated her medical practice and

Q88: What incentives do the tax accounting rules

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents