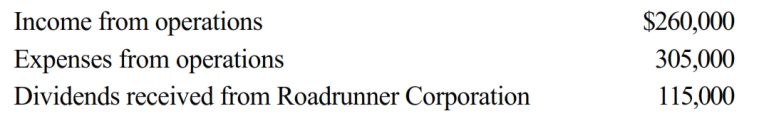

During the current year, Coyote Corporation (a calendar year C corporation) has the following transactions:

a. Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b. Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: For tax years ending after 2017, which

Q81: Ostrich, a C corporation, has a net

Q82: Heron Corporation, a calendar year, accrual basis

Q83: In each of the following independent situations,

Q84: Nancy is a 40% shareholder and president

Q86: On December 28, 2018, the board of

Q87: During the current year, Quartz Corporation (a

Q88: During the current year, Skylark Company (a

Q90: During the current year, Gray Corporation, a

Q127: Contrast the tax treatment of capital gains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents