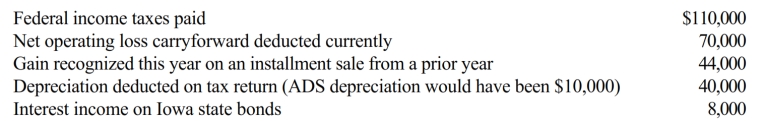

Rose Corporation (a calendar year taxpayer) has taxable income of $300,000, and its financial records reflect the following for the year.

Rose Corporation's current E & P is:

A) $254,000.

B) $214,000.

C) $194,000.

D) $104,000.

E) None of the above.

Correct Answer:

Verified

Q43: In general, if a shareholder's ownership interest

Q46: For purposes of the waiver of the

Q47: For purposes of a partial liquidation, the

Q48: Grackle Corporation (E & P of $600,000)

Q50: Betty's adjusted gross estate is $18 million.

Q51: Puffin Corporation's 2,000 shares outstanding are owned

Q52: Reginald and Roland (Reginald's son) each own

Q58: In determining whether a distribution qualifies as

Q59: Six years ago, Ronald and his mom

Q60: In applying the § 318 stock attribution

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents