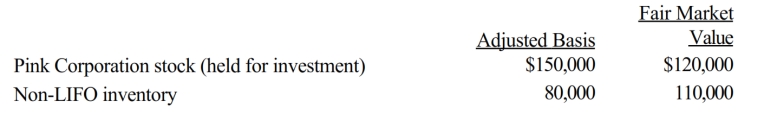

In the current year, Warbler Corporation (E & P of $250,000) made the following property distributions to its shareholders (all corporations) :

Warbler Corporation is not a member of a controlled group. As a result of the distribution:

A) The shareholders have dividend income of $200,000.

B) The shareholders have dividend income of $260,000.

C) Warbler has a recognized gain of $30,000 and a recognized loss of $30,000.

D) Warbler has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Q92: Purple Corporation makes a property distribution to

Q93: Brett owns stock in Oriole Corporation (basis

Q94: On January 1, Eagle Corporation (a calendar

Q95: Seven years ago, Eleanor transferred property she

Q96: Which one of the following statements is

Q98: Which of the following is not a

Q99: On January 30, Juan receives a nontaxable

Q100: Pink Corporation declares a nontaxable dividend payable

Q101: Which of the following is an incorrect

Q102: The adjusted gross estate of Keith, decedent,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents