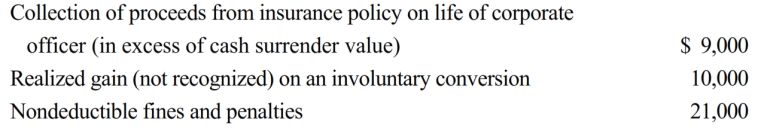

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Correct Answer:

Verified

The realized gain ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q138: Using the legend provided, classify each statement

Q139: Which of the following statements is correct

Q140: Using the legend provided, classify each statement

Q141: Brown Corporation, an accrual basis corporation, has

Q142: At the beginning of the current year,

Q145: Scarlet Corporation is an accrual basis, calendar

Q146: Lena is the sole shareholder and president

Q147: On January 1, Gold Corporation (a calendar

Q154: Stephanie is the sole shareholder and president

Q155: Finch Corporation (E & P of $400,000)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents