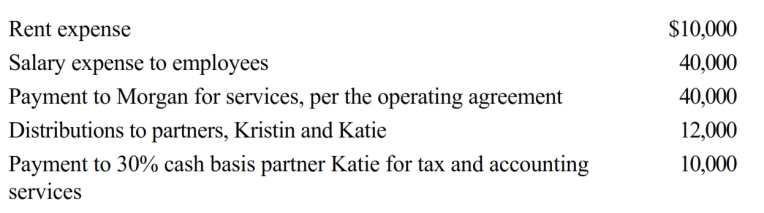

Morgan is a 50% managing member in the calendar year, cash basis MKK LLC. The LLC received $150,000 income from services and paid the following other amounts.

How much will Morgan's adjusted gross income increase as a result of the above items? What amount will be included in Morgan's self-employment tax calculation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q156: An examination of the RB Partnership's tax

Q159: Carli contributes land to the newly formed

Q164: A distribution can be "proportionate" (as defined

Q165: The MOP Partnership is involved in construction

Q166: The MOG Partnership reports ordinary income of

Q187: The LN partnership reported the following items

Q194: Match each of the following statements with

Q206: In the current year, the CAR Partnership

Q221: On the formation of a partnership, when

Q222: Harry and Sally are considering forming a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents