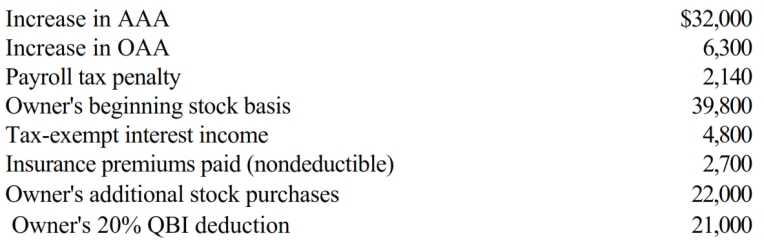

You are given the following facts about a 50% owner of an S corporation. Compute her ending stock basis.

A) $80,950.

B) $85,750.

C) $100,100.

D) $106,225.

Correct Answer:

Verified

Q81: Lemon Corporation incurs the following transactions.

Q82: A calendar year C corporation reports a

Q83: Which type of distribution from an S

Q84: Which, if any, of the following items

Q85: At the beginning of the year, the

Q87: On January 2, 2018, Tim loans his

Q88: You are given the following facts about

Q89: On January 2, 2018, David loans his

Q90: Oxen Corporation incurs the following transactions.

Q91: Claude Bergeron sold 1,000 shares of Ditta,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents