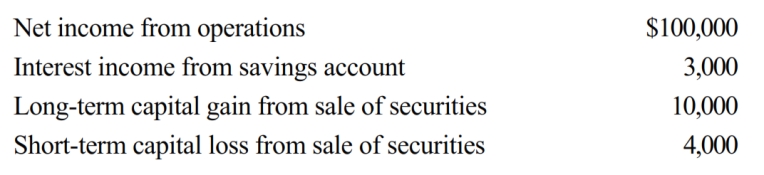

Oxen Corporation incurs the following transactions.

Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan. As a result, Megan must recognize (ignore 20% QBI deduction) :

A) Ordinary income of $103,000.

B) Ordinary income of $103,000 and long-term capital gain of $6,000.

C) Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss.

D) Ordinary income of $109,000.

Correct Answer:

Verified

Q85: At the beginning of the year, the

Q86: You are given the following facts about

Q86: Pepper, Inc., an S corporation, holds a

Q87: On January 2, 2018, Tim loans his

Q88: You are given the following facts about

Q89: On January 2, 2018, David loans his

Q91: Claude Bergeron sold 1,000 shares of Ditta,

Q93: Mock Corporation converts to S corporation status

Q95: Samantha owned 1,000 shares in Evita, Inc.,

Q100: This year, Jiang, the sole shareholder of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents