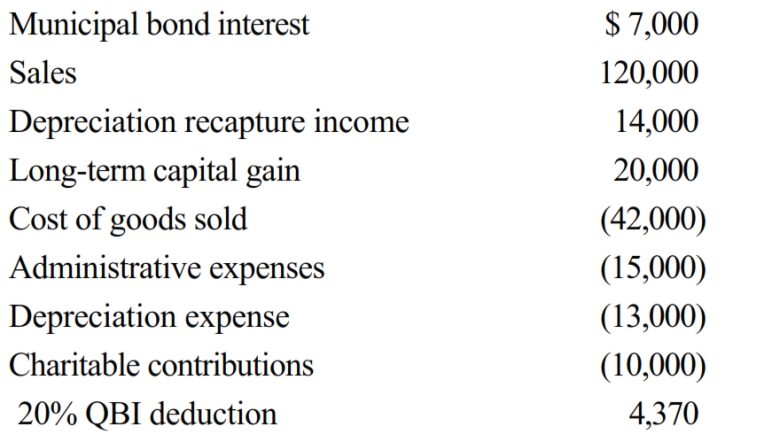

Estella, Inc., a calendar year S corporation, incurred the following items during the tax year.

Calculate Estella's nonseparately computed income.

Correct Answer:

Verified

Q71: Which of the following reduces a shareholder's

Q84: Some _and taxation rules apply to an

Q96: On January 1, Bobby and Alice own

Q98: A cash basis calendar year C corporation

Q99: Donna and Mark are married and file

Q100: If the beginning balance in OAA is

Q101: Nonseparately computed loss (increases, reduces) a S

Q112: Separately stated items are listed on Schedule

Q118: Since loss property receives a in basis

Q120: An S corporation's separately stated items generally

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents