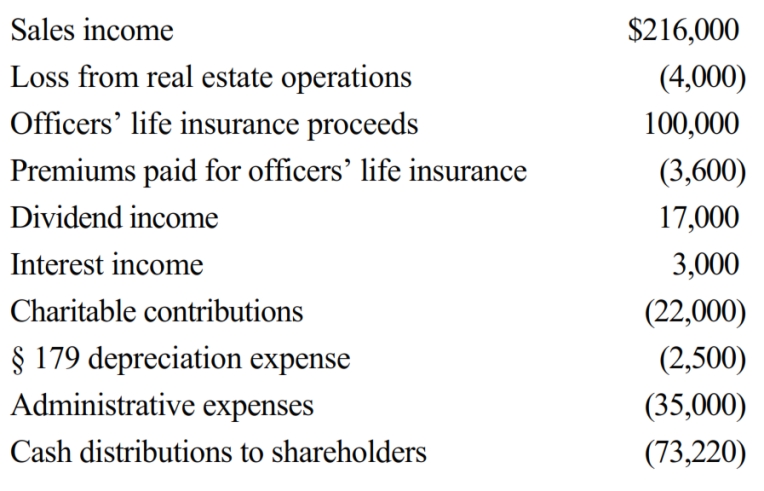

Towne, Inc., a calendar year S corporation, holds AAA of $627,050 at the beginning of the tax year. During the year, the following items occur.

Calculate Towne's ending AAA balance.

Correct Answer:

Verified

Q83: Shareholders owning a(n) of shares (voting and

Q94: As with partnerships, the income, deductions, and

Q96: If any entity electing S status is

Q97: The choice of a flow-through entity for

Q103: Stock basis first is increased by income

Q106: Depreciation recapture income is a (separately, nonseparately)

Q107: The exclusion of on the disposition of

Q108: An S corporation's LIFO recapture amount equals

Q115: In the case of a complete termination

Q117: Lent Corporation converts to S corporation status

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents