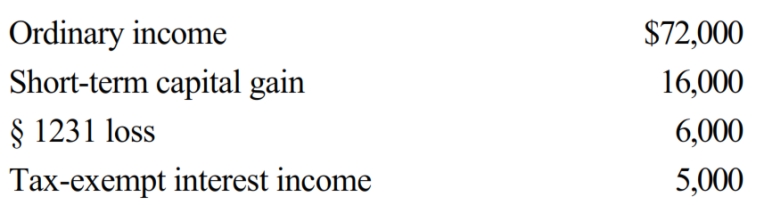

Gene Grams is a 45% owner of a calendar year S corporation during the tax year. His beginning stock basis is $230,000, and the S corporation reports the following items.

Calculate Grams's stock basis at year-end.

Correct Answer:

Verified

Q102: On December 31, Erica Sumners owns one

Q107: The exclusion of on the disposition of

Q113: Discuss two ways that an S election

Q115: In the case of a complete termination

Q117: Advise your client how income, expenses, gain,

Q121: You are a 60% owner of an

Q121: Explain the OAA concept.

Q122: Pepper, Inc., an S corporation in Norfolk,

Q123: Bidden, Inc., a calendar year S corporation,

Q128: Alomar, a cash basis S corporation in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents