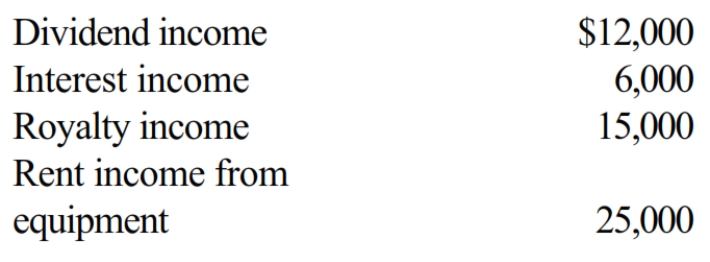

City, Inc., an exempt organization, has included among other amounts the following in calculating net unrelated business income of $500,000.

The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Identify the components of the tax model

Q110: Define a private foundation.

Q114: Are organizations that qualify for exempt organization

Q120: Arbor, Inc., an exempt organization, leases land,

Q124: Which exempt organizations are not required to

Q129: If an exempt organization distributes "low-cost items"

Q135: Midnight Basketball, Inc., an exempt organization that

Q137: Agnes is aware that a feeder organization

Q138: Describe how an exempt organization can be

Q141: Plus, Inc., is a § 501(c)(3) organization.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents