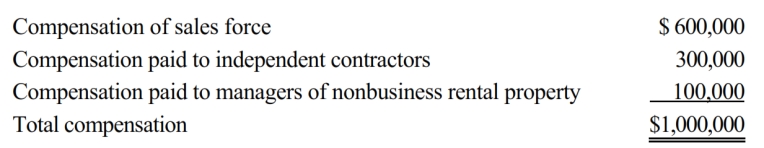

Given the following transactions for the year, determine Comp Corporation's D payroll factor denominator. State D has adopted the principles of UDITPA.

A) $1,000,000

B) $900,000

C) $700,000

D) $600,000

Correct Answer:

Verified

Q62: The throwback rule requires that:

A) Sales of

Q83: With respect to typical sales/use tax laws:

A)

Q92: For sales/use tax purposes, nexus usually requires

Q93: In most states, a consolidated corporate income

Q94: Guilford Corporation is subject to franchise tax

Q95: A local property tax:

A) Applies to the

Q96: Valdez Corporation, a calendar-year taxpayer, owns property

Q99: A use tax applies when a State

Q101: Parent and Junior form a unitary group

Q102: Under Public Law 86-272, a state is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents