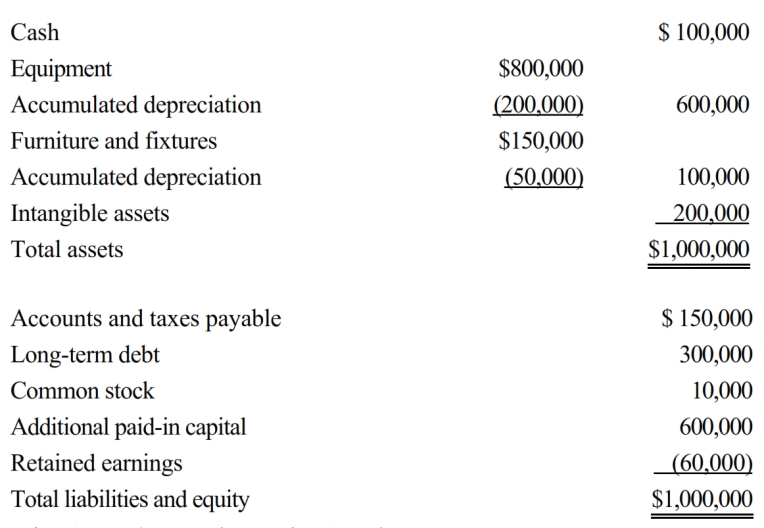

Guilford Corporation is subject to franchise tax in State Z. The tax is imposed at a rate of 2.5% of the taxpayer's net worth that is apportioned to the state by use of a two factor (sales and property equally weighted) formula. The property factor includes real and tangible personal property, valued at net book value at the end of the taxable year. Sixty percent of Guilford's sales are attributable to Z, and $200,000 of the net book value of Guilford's tangible personal property is located in Z. Determine the Z franchise tax payable by Guilford this year, given the following end-of-the year balance sheet.

A) $0, due to the negative retained earnings

B) $6,050

C) $8,250

D) $13,750

Correct Answer:

Verified

Q83: With respect to typical sales/use tax laws:

A)

Q89: Trayne Corporation's sales office and manufacturing plant

Q90: Bert Corporation, a calendar-year taxpayer, owns property

Q91: Ting, a regional sales manager, works from

Q92: For sales/use tax purposes, nexus usually requires

Q93: In most states, a consolidated corporate income

Q95: A local property tax:

A) Applies to the

Q96: Valdez Corporation, a calendar-year taxpayer, owns property

Q97: Given the following transactions for the year,

Q99: A use tax applies when a State

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents